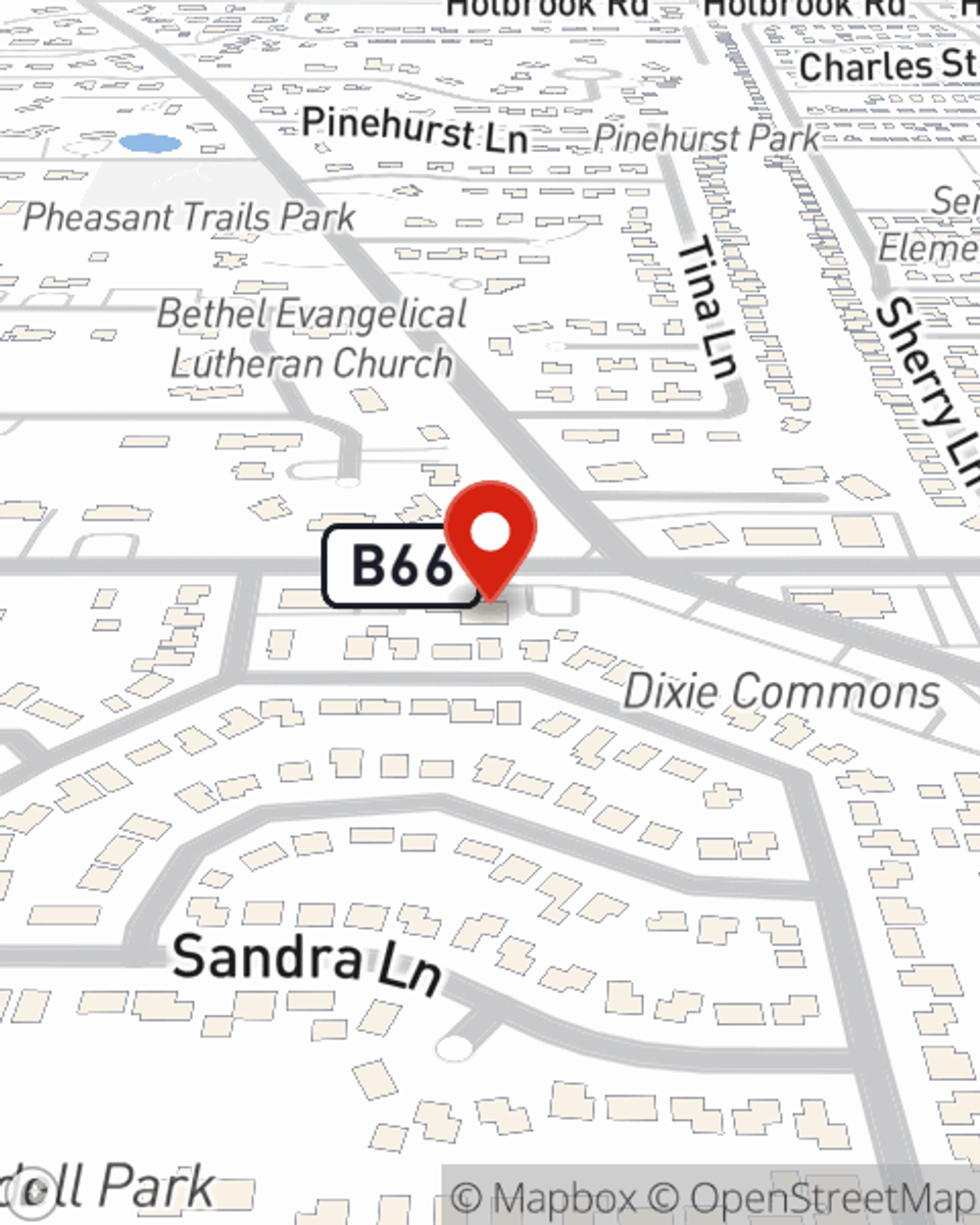

Life Insurance in and around Chicago Heights

Life goes on. State Farm can help cover it

Life happens. Don't wait.

Would you like to create a personalized life quote?

Check Out Life Insurance Options With State Farm

It may make you weary to contemplate when you pass away, but preparing for that day with life insurance is one of the most significant ways you can express love to your family.

Life goes on. State Farm can help cover it

Life happens. Don't wait.

Life Insurance Options To Fit Your Needs

Death may be part of life but that doesn’t make it easy. With life insurance from State Farm, loss can be a bit less overwhelming. Life insurance provides financial support when it’s needed most. Coverage from State Farm allows time to grieve without worrying about expenses like college tuition, future savings or childcare costs. You can work with State Farm Agent Julie Nash to extend care for the ones you hold dear with a policy that meets your specific situation and needs. With life insurance from State Farm, you and your loved ones will be cared for every step of the way.

With reliable, caring service, State Farm agent Julie Nash can help you make sure you and your loved ones have coverage if life doesn't go right. Contact Julie Nash's office now to learn more about the options that are right for you.

Have More Questions About Life Insurance?

Call Julie at (708) 798-3550 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.